Bitcoin has been making national headlines. Supporters of the trending peer-to-peer cryptocurrency continue to sing praises of its benefits, while critics have highlighted a number of problems that have plagued the Bitcoin movement.

Since its inception in 2009, businesses have been on the fence about whether to accept Bitcoin as payment for their goods or services. Do the benefits outweigh the risks?

Bitcoin’s Benefits for Small Businesses

Implementing Bitcoin at your business could come with a few notable advantages:

- Getting started is a snap: Unlike with credit card processors, small business owners don’t need “permission” to start using Bitcoin. Once Bitcoin users have applied and joined the network, they can start accepting Bitcoin payments immediately.

- Lower transaction fees: While credit cards processors charge between 2–3% per transaction, Bitpay and similar Bitcoin processors charge less than 1%. Additionally, since Bitcoin is one worldwide currency, all costs associated with foreign currency exchange are eliminated.

- Transaction finality: Bitcoin transactions that are completed are non-refundable and can’t be reversed or even disputed by the customer. Merchants may choose to make a return deposit, but Bitcoin doesn’t step in and require them to do so.

- Getting your name out there: Small businesses using Bitcoin will be automatically listed by online directories of businesses accepting Bitcoin. Also, Bitcoin-paying customers tend to remain loyal to those businesses that cater to their cryptocurrency.

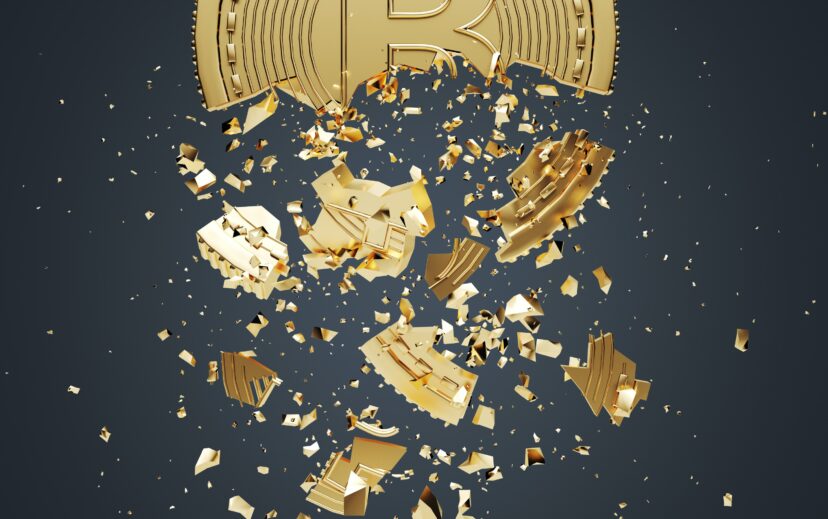

Accepting Bitcoin Comes With Risks

Despite its potential benefits to small business owners, Bitcoin is plagued by uncertainty:

- Security: Bitcoins are held in encrypted online accounts called “wallets.” These wallets, however, are unregulated and prone to fraud, hacking and other cyber-attacks. When the Tokyo-based Bitcoin exchange Mt. Gox reported that it had “lost” hundreds of thousands of Bitcoins, the value of a single Bitcoin plummeted from $1209 to $122.

- Instability: The Bitcoin exchange rate is extremely volatile, which means that the value of a small business’s Bitcoins could go from a lot to a little in no time flat. Just this weekend, prices plummeted by over 11% in less than 24 hours. Take a look for yourself—spend a few minutes watching the Bitcoin exchange rate for an idea of how volatile the cryptocurrency really is.

- Taxes and bookkeeping: Recently, the IRS announced that Bitcoin will be treated as property for tax purposes. The IRS’s ruling means that the transfer of Bitcoin will have capital gains tax consequences for everyday purchases, which will pose a huge burden to small business owners when accounting for Bitcoin transactions during tax time.

- Bitcoin seizures: Despite its increasing popularity in mainstream commerce, Bitcoin is notorious for its popularity with the criminal world. The government can trace Bitcoins directly involved in criminal activity and might confiscate them from Bitcoin users further down the chain of commerce if fraud and theft continue to haunt the cryptocurrency community.

The Bitcoin Gamble

Is cryptocurrency too risky for the average small business owner? Bitcoin remains unregulated, unstable and volatile, which seems to be dissuading many small business owners from accepting the new payment method.

Is the risk of accepting Bitcoin payments worth the rewards for small business owners? Would you accept a Bitcoin payment? If so, would you hold the Bitcoins as currency or cash them in right away?

Contact an Attorney Today

The experienced attorneys at Romano Law are ready to help. Contact us at 212-865-9848 or complete this form to speak to a member of our team!