If you have been laid off or had your hours reduced because of the coronavirus, your financial concerns have likely skyrocketed. Federal and state governments are attempting to address these issues and provide assistance to workers. However, the rules are continuously changing to adapt to these circumstances. That can be confusing and keep your head spinning. So, here’s a brief breakdown of the current provisions that apply to workers.

Federal Law

The Families First Coronavirus Response Act provides paid sick and family leave to employees affected by the coronavirus. The law applies to private employers with fewer than 500 employees and provides them with a refundable tax credit for the entire qualified sick leave wages paid to their employees. Qualified full-time employees can receive up to 80 hours of paid leave. Part-time employees can get the equivalent number of hours that they worked over a two week period. To qualify, employees must either be unable to work because they have or suspected to have COVID-19, be caring for someone else who has or may have COVID-19, or be caring for a child whose school or daycare is closed. Keep in mind, there are monetary caps on the payments.

The Act also provides employees with up to 12 weeks of family leave for a qualifying need related to the coronavirus. Although the first two weeks are unpaid, the remaining weeks are paid at a reduced rate, where the reduced pay is either at least two-thirds of an employee’s regular pay rate and at most $200 per day, or an aggregate of $10,000 per worker. Businesses with less than 50 employees may qualify for a hardship exemption. Additionally, self-employed business owners and independent contractors can receive tax credits if they cannot work due to the coronavirus as described above.

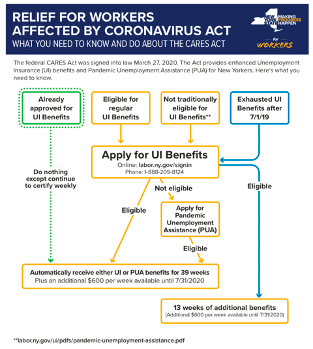

Employees and employers should take advantage of these provisions before seeking unemployment insurance. Both the amount and duration of unemployment benefits have been increased. Those eligible receive an additional 13-weeks of payments as well as an extra $600 per week on top of their regular state law unemployment benefits. Individuals who were already receiving unemployment benefits pre-COVID-19 also receive the additional payments. However, the law does not apply to workers who are able to work from home, those who are receiving paid sick leave or family medical leave, and new entrants to the workforce who cannot find jobs.

New York Law

New York also provides paid sick and family leave. Emergency paid leave applies to those who have been diagnosed with, have symptoms of, or quarantined for COVID-19. People caring for those with COVID-19 or caring for children whose schools have closed due to COVID-19 may also qualify for emergency paid leave. New York supplements the benefits offered by the federal government, providing up to the difference between the benefits offered by New York and federal laws. The amount an employer is required to provide for paid sick leave in New York varies depending on the number of employees and the employer’s net annual income.

With respect to unemployment insurance, New York’s rules have also changed. Previously, the law required that an employee must be laid off to qualify for unemployment benefits. With the current COVID-19 challenges, the rules have been relaxed. Employees can qualify for full or partial unemployment benefits if they cannot work or have had hours significantly cut as a result of COVID-19 closures or quarantines. Further, New York has waived the 7-day waiting period to apply for unemployment insurance benefits.

Employees may receive partial unemployment insurance benefits if their hours were cut. To qualify, they must work fewer than four days a week and not earn over the maximum rate of $504 per week. The amount paid varies depending on how many days per week the employee continues to work.

As noted above, unemployed individuals are eligible for the extra $600 per week in payments and 13 weeks of benefits. These are added to the existing 26 weeks for a total of 39 weeks of unemployment benefits.

This area is fast changing. Both employers and employees should stay abreast of government programs designed to ease the financial burden caused by business cutbacks related to the coronavirus.

Breakdown: https://www.labor.ny.gov/ui/cares-act.shtm

Contact an Attorney Today

The experienced attorneys at Romano Law are ready to help. Contact us at 212-865-9848 or complete this form to speak to a member of our team!